For residential rental properties located in Ontario, you may be eligible to claim the Ontario NRRP rebate if you are not eligible to claim the NRRP rebate for some of the federal part of the HST only because the fair market value of the qualifying residential unit exceeds $450,000. For more information, see GST/HST Info Sheet GI-093, Harmonized Sales Tax: Ontario New Residential Rental.. The High-Efficiency Electric Home Rebate (HEEHR) Program provides point-of-sale consumer discounts to enable low- and moderate-income households across America to electrify their homes. Notably, households will experience HEEHRA’s point-of-sale rebates as immediate, off-the-top discounts when making qualifying electrification purchases.

How Do The New Home HST Rebate Rules In Ontario Apply To You? GST/HST New Residential Rental

Why Do I Pay The HST Rebate Up Front On Rental Properties?

New Housing HST Rebate Claims Lawyer for Toronto, Scarborough, Markham, Ajax, Pickering and

Why Was I Denied An HST Rebate In Ontario? My Rebate

GST HST Rebate For OwnerBuilt Homes Sproule & Associates

HST New Housing Rebate Canadian Property Expert

New Condo HST Rebate Sproule + Associates

TAX REBATE BLOG SERIES GST HST New Housing Rebate

FAQ GST/HST Rebate Information Sproule & Associates

How Much HST Do You Pay On A New Home? Sproule + Associates

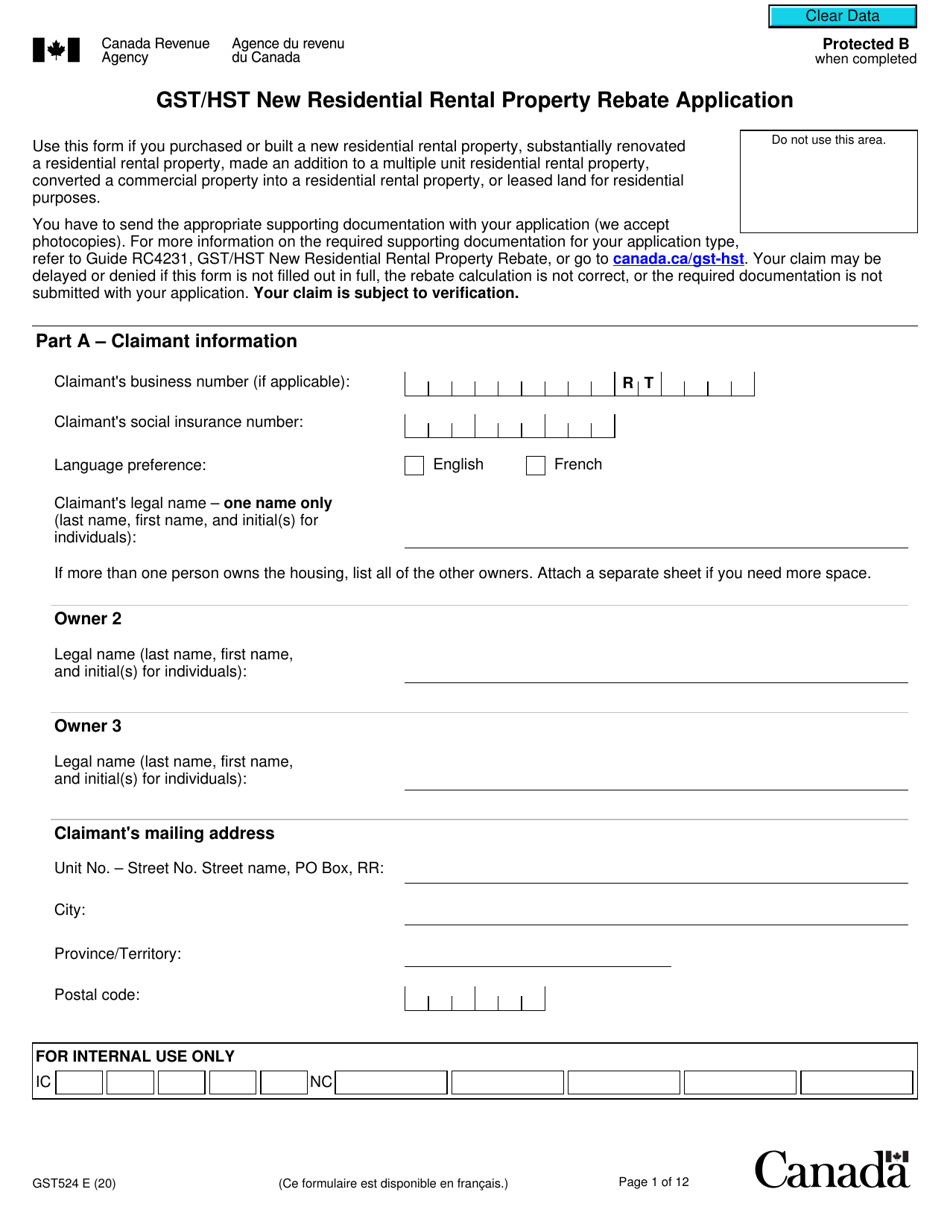

Form GST524 Download Fillable PDF or Fill Online Gst/Hst New Residential Rental Property Rebate

Top 5 Questions About The GST/HST Housing Rebate

Top 5 Common Mistakes To Avoid When Claiming The HST Rebate

New Residential Rental Property Rebate Calculator

HST Rebate Ontario Services New & Custom Homes, Condos & Rentals

June tax news Buying property from a nonresident, HST rulesand more KRP

Buying real estate can be exciting, but as soon as you mention HST — the excitement fades and

New Condo HST Rebates Sproule + Associates

The New Residential Rental Property HST Rebate LRK Tax LLP

GST HST New Housing Rebate And New Residential Rental Property Rebate

If you recently bought a newly-built home or invested in renovations, whether as your principal residence or as a residential rental property, you may be entitled to an HST Rebate. Contact us for a complimentary assessment of your HST position. Call us at 1-888-544-5467 today!. Zillow has 102 single family rental listings in 89141. Use our detailed filters to find the perfect place, then get in touch with the landlord.